Understanding Sequence of Returns Risk

When planning for retirement, one crucial factor often overlooked is the sequence of returns risk. This term refers to the variability and uncertainty of the order in which investment returns occur and is particularly impactful during the withdrawal phase in retirement. Unlike average returns that blend gains and losses over the years into a smooth figure, sequence of returns emphasizes the timing of these returns, especially when you start withdrawing money from your retirement savings.

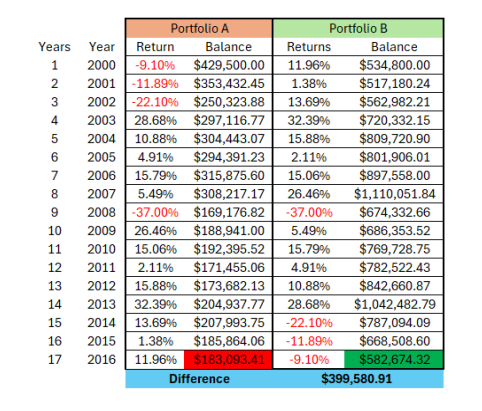

A clear illustration of sequence of returns risk can be seen in the comparative analysis outlined in the table below.

Portfolio A displays the investment returns from 2000 to 2016 in chronological order, while Portfolio B presents these same returns in reverse order. The results are telling: Portfolio A concludes the period with a remaining balance of $183,093, whereas Portfolio B finishes with a significantly higher balance of $582,674—a stark difference of $399,580. This disparity highlights the profound impact that early negative returns can have on the sustainability of a portfolio during the initial phases of retirement withdrawals.

This risk is unique because it underscores that it’s not just how much your investments return on average, but when these returns occur relative to when you are drawing on your investments.

Sequence of Returns Risk During Accumulation vs. Distribution Phases

The sequence of returns risk affects individuals differently depending on whether they are in the accumulation phase (saving for retirement) or the distribution phase (withdrawing during retirement). During the accumulation phase, the risk is relatively low. Over a long period, the highs and lows of market returns tend to average out. Early losses can be offset by later gains, and since there are no withdrawals reducing the balance, the portfolio has more time to recover from downturns. This is often referred to as 'dollar-cost averaging,' where ongoing investments can buy more shares when prices are low and fewer when prices are high, potentially reducing the average cost per share over time.

However, during the distribution phase, when retirees begin withdrawing funds to cover living expenses, the sequence of returns becomes critically important. Starting your retirement during a bear market or a period of low returns can deplete your savings more rapidly than if the same returns occurred later. This difference stems from having to sell off more investments to maintain the same withdrawal rate, potentially locking in losses and reducing the amount of capital that can benefit from future market recoveries.

Mitigating Sequence of Returns Risk

Fortunately, there are multiple strategies to mitigate the sequence of returns risk, ensuring a more stable financial foundation during retirement:

1. Maintain a cash reserve: Having a cash buffer can help manage withdrawals during market downturns without having to sell investments at a loss. This reserve can act as a financial shock absorber, allowing the portfolio more time to recover

2 .Diversify your investment portfolio: A well-diversified portfolio that includes a mix of stocks, bonds, and other assets can help buffer against market volatility. Bonds and other fixed-income investments often provide returns that counterbalance the risks of equity markets, offering steadier income streams during down periods.

3. Use a conservative withdrawal rate: Adhering to a conservative withdrawal strategy, such as the 4% rule, can reduce the risk of depleting your retirement funds too early. This strategy involves withdrawing a fixed, sustainable percentage from your portfolio each year, adjusted for inflation, regardless of market conditions.

4. Consider annuities: Annuities can provide a guaranteed income stream regardless of market conditions, which can be particularly useful to cover basic living expenses. This can reduce the pressure on the investment portfolio to perform, particularly during the critical early years of retirement

5. Delay Social Security benefits: Opting to delay the start of Social Security benefits can increase the monthly benefits, providing a larger financial base later in retirement. This can be a strategic move to counteract poor market performance in the early years of retirement.

By understanding and preparing for the sequence of returns risk, retirees can better safeguard their financial future, ensuring that they have enough funds to enjoy their retirement years without undue stress over market conditions. These strategies can help create a buffer against timing risks, making the transition from the accumulation to distribution phase smoother and more secure.

If you're interested in learning how to implement strategies that mitigate sequence of returns risk, we invite you to schedule an initial consultation. At Encompass Advisory Services, an independent Registered Investment Advisory firm, we are committed to partnering with you to navigate through your retirement planning with expertise and care.