By Jason W. Ceyanes, Sr., Ph.D., CFP®

•

October 21, 2025

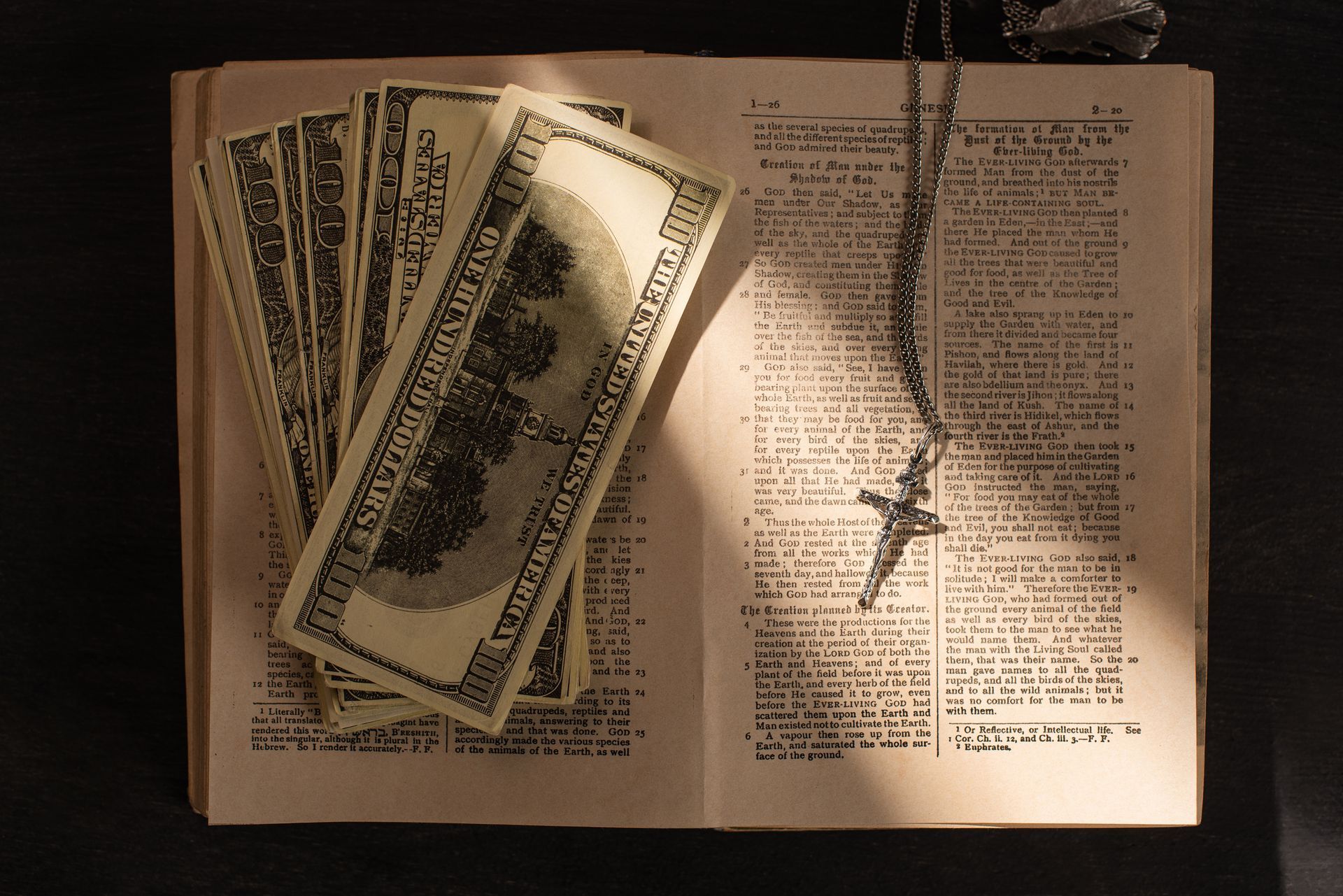

When I speak about stewardship—whether in the context of financial planning, family leadership, or faith—I’m not just referring to managing money well. Stewardship, in its truest biblical sense, is about ownership and trust. It’s the recognition that God owns everything , and we are simply caretakers of what He has entrusted to us. Psalm 24:1 declares, “The earth is the Lord’s, and everything in it, the world, and all who live in it.” That verse sets the foundation for a proper understanding of biblical stewardship: God is the owner; we are the stewards. A steward is someone who manages the affairs of another. In biblical times, a steward might have overseen a household, managed crops, or distributed resources on behalf of the master. Today, that stewardship extends into our finances, our families, our health, our time, and our spiritual gifts. Everything we possess—our careers, our influence, our resources—has been temporarily placed in our care. God has made us managers, not owners, and that distinction carries both privilege and accountability . Ownership and Accountability Jesus reinforced this principle in the Parable of the Talents (Matthew 25:14-30). The master entrusts his servants with resources “each according to his ability.” Two servants invest wisely and multiply what they’ve been given; the third hides his portion out of fear. When the master returns, he praises the faithful stewards but rebukes the one who buried his talent. The lesson is timeless: God expects us to use, grow, and multiply what He has placed in our hands—not to waste it or guard it out of fear. Stewardship requires faith in action. It’s not about how much we have, but how faithfully we manage what we’ve been given. In modern terms, this means we are accountable for every resource God has entrusted to us—our money, our children, our businesses, our influence, and our opportunities. Luke 16:10 reminds us, “Whoever can be trusted with very little can also be trusted with much.” True stewardship begins with faithfulness in the small things. If we’re careless with little, we cannot be trusted with greater blessings. Stewardship and Generosity One of the most visible expressions of stewardship is generosity. When we give, we acknowledge that what we have belongs to God. Giving is not about losing something—it’s about returning what already belongs to Him. Second Corinthians 9:6-7 teaches that “whoever sows sparingly will also reap sparingly, and whoever sows generously will also reap generously.” Generosity is the fruit of gratitude and trust. It declares that our confidence is not in our bank accounts or possessions, but in the Provider Himself. As a financial planner and Christian leader, I’ve seen this principle change lives. When people move from ownership to stewardship, fear gives way to freedom. They begin to see money not as a master, but as a ministry tool —a way to advance God’s purposes. Stewardship is about aligning financial decisions with eternal values. It’s budgeting with wisdom, investing with purpose, and giving with joy. Stewardship Beyond Finances Stewardship extends far beyond money. It encompasses how we treat our bodies, how we raise our families, and how we use our time and talents. First Peter 4:10 tells us, “Each of you should use whatever gift you have received to serve others, as faithful stewards of God’s grace in its various forms.” Our lives are a sacred trust. Whether you are a teacher, business owner, pastor, or parent, your calling is a form of stewardship. God has given you influence and responsibility. How you use them reveals your heart toward Him. Time, for example, is one of our most valuable yet limited resources. Every hour we waste is one we can never recover. Colossians 3:23-24 instructs us to “work heartily, as for the Lord and not for men.” Stewardship means living intentionally—working diligently, resting wisely, and remembering that even our leisure can glorify God when it’s used to refresh and restore the vessel He’s entrusted to His purposes. The Eternal Perspective Ultimately, stewardship is an act of worship. It’s the daily decision to honor God with all that we have and all that we are. It’s saying, “Lord, I recognize that none of this is mine. I am merely the manager of Your blessings.” When we live with that mindset, everything changes. We stop chasing temporary success and start investing in eternal impact. In the end, the question we will each face is not “How much did you earn?” or “What did you build?” but rather, “How faithful were you with what I gave you?” The faithful steward lives with eternity in view—using today’s resources to shape tomorrow’s Kingdom. As Proverbs 3:5-6 reminds us, “Trust in the Lord with all your heart and lean not on your own understanding; in all your ways submit to Him, and He will make your paths straight.” That is the heartbeat of biblical stewardship—trusting God fully, managing His blessings wisely, and walking faithfully until the day He says, “Well done, good and faithful servant.”