Our Mission, Vision, and Core Values

At Encompass Advisory Services, we believe in weaving together the pillars of faith, family, fitness and fun with comprehensive financial planning. Our mission is to empower individuals to achieve holistic well-being and lasting financial security.

Our Mission Statement

Encompassing Faith, Family, Fitness, and Fun through Financial Planning.

Our Vision

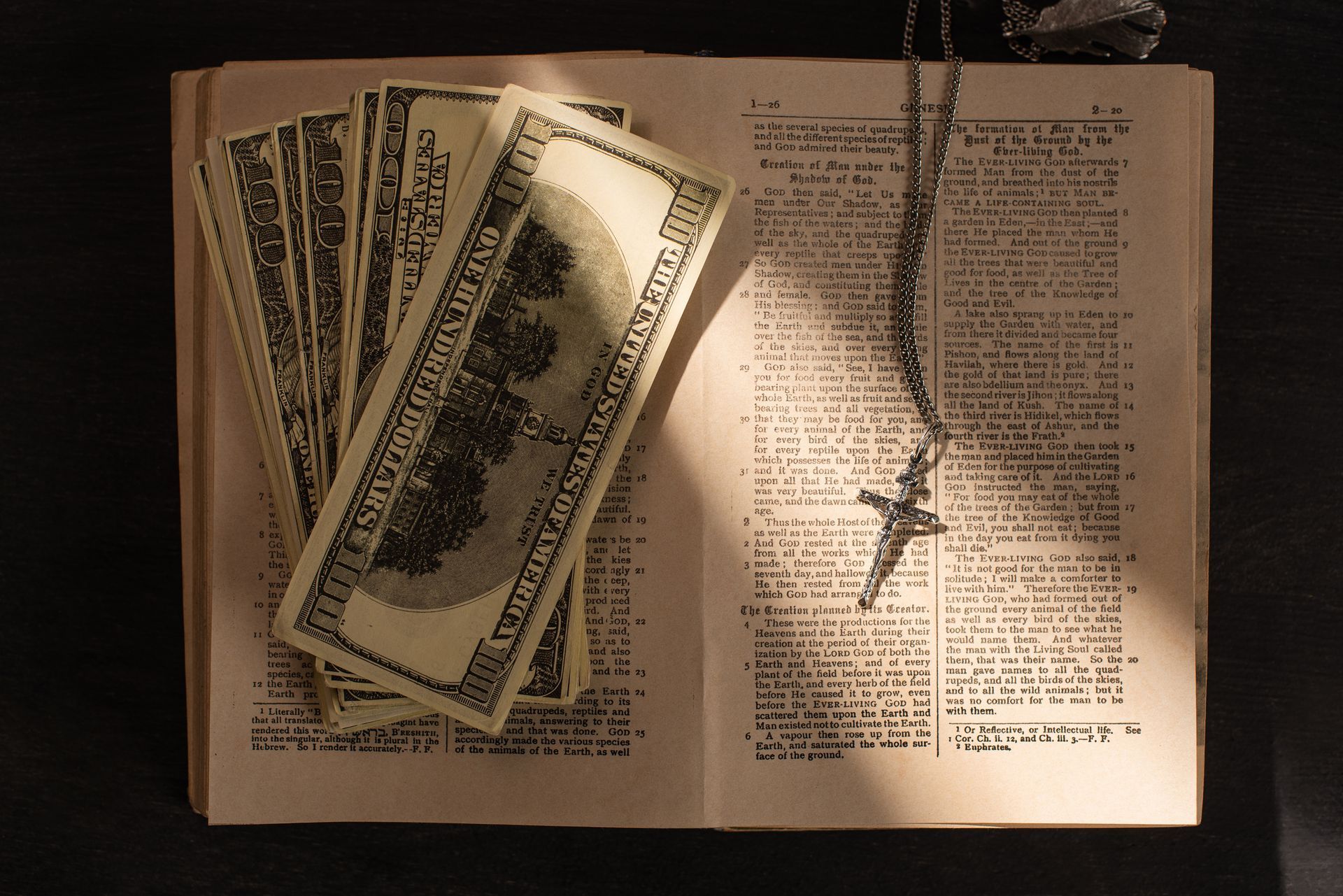

To impact the world by implementing biblically based principles through financial planning for our clients and our firm while expanding the Kingdom of God.

Our Core Values

Embracing Faith – Financial planning allows us to fully experience our faith by financially supporting our churches, communities, and charities while growing as individuals and giving to others.

Strengthening Families – Financial planning allows us to maximize our family experiences by meeting our current financial obligations, generating wealth, preparing our children for the future, and growing old together in retirement.

Focusing on Fitness – Financial planning allows us to live longer healthier lives by eating more nutritious foods, staying more active, purchasing nutritional products, and providing for medical necessities that prolong life.

Having Fun – Financial planning allows us to have fun both now and in the future by providing the time and money to enjoy our hobbies such as travel, sporting events, eating out, and spending time with family and friends.

Acting as a Fiduciary – Fiduciary financial planning allows us to always place our clients’ needs above the needs of ourselves and our firm by making recommendations and decisions that are in the best interests of our clients.

Guiding Biblical Scripture

Trust in the Lord with all of your heart and lean not on your own understanding. In all your ways acknowledge Him, and He shall direct your path. – Proverbs 3:5-6.

Through personalized strategies and unwavering dedication, we strive to guide our clients towards a future where their financial goals align seamlessly with their deepest values. Together, we journey towards a life enriched by faith, strengthened by family bonds, and nurtured by physical vitality.

Our Services

At Encompass Advisory Services (EAS), we offer all-encompassing financial planning and investment management solutions for an array of clients, such as individuals, businesses, pensions, trusts and estates, charitable organizations, and profit sharing plans.

We understand that every client has unique needs that demand the expertise of a team with diverse skills. Our first step is to meet with you and gain a comprehensive understanding of your investment goals. Ensuring your principal is protected is our top priority at all times. As we progress, we explore a variety of options and customize a plan that fits your specific requirements. Trust us to help guide you to financial success.

LATEST NEWS AND ANNOUNCEMENTS